Advice from Ausdance NSW

Financial Assistance for Dance Businesses and Workers

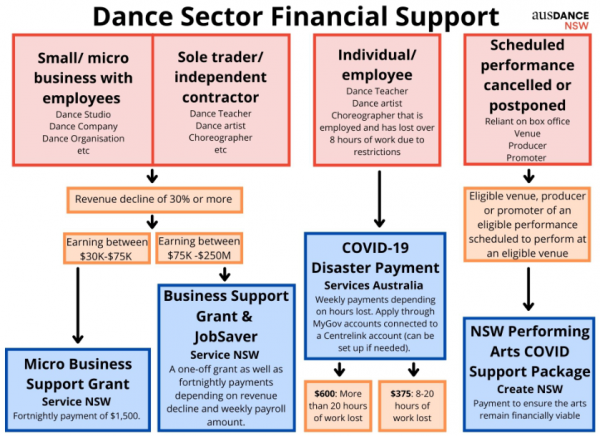

Financial support is the number one concern for dance workers right now, please see the information below on financial support currently available. If you need further clarification on this or if you believe this none of this will apply to you or if you need any further support please get in touch with Ausdance NSW.

$75 MILLION STIMULUS PACKAGE FOR PERFORMING ARTS SECTOR

Applications for this funding package opened July 23 through the Create NSW website. The package will be delivered in two stages:

- Immediate support to provide relief to eligible organisations who were staging performances during the period covered by the Public Health Orders

- Funding is available to support eligible organisations to reschedule performances once it is safe for restrictions to ease.

NSW FINANCIAL ASSISTANCE PACKAGES

Below is a summary of the packages announced. NB: all support is available to people from all areas of NSW that are affected and can show eligibility, not just Greater Sydney.

- Micro-Business Support Grant

- A fortnightly payment of $1,500 for small businesses and sole traders with a turnover between $30K and $75K that have experienced a revenue decline of 30% or more. Eligible businesses also must provide the primary source of income for a person associated with the business. Applications are set to open on the 26th July.

To be notified when applications open and for more information, click here>>

- A fortnightly payment of $1,500 for small businesses and sole traders with a turnover between $30K and $75K that have experienced a revenue decline of 30% or more. Eligible businesses also must provide the primary source of income for a person associated with the business. Applications are set to open on the 26th July.

- Business Support Grant

- A one-off grant of up to $15,000 is available for NSW businesses and sole traders who had a turnover of more than $75K per annum for the year ending 30 June 2020. Different grant amounts are available depending on the decline in turnover experienced during the restrictions. Applications for this are now open.

More information on this and applications can be found here >>

- A one-off grant of up to $15,000 is available for NSW businesses and sole traders who had a turnover of more than $75K per annum for the year ending 30 June 2020. Different grant amounts are available depending on the decline in turnover experienced during the restrictions. Applications for this are now open.

- JobSaver

- A fortnightly payment is available to help maintain employee headcount and provide cashflow support to businesses with a turnover between $75K and $50 million that have experienced a revenue decline of 30% or more. The fortnightly payment amount is determined for employing businesses by 40% of their weekly payroll (minimum payment of $1,500 and maximum payment of $10,000 per week). For non-employing businesses, the fortnightly payment is $1000 a week. Applications open in late July, with no date currently specified.

To be notified when applications open and for more information, click here>>

- A fortnightly payment is available to help maintain employee headcount and provide cashflow support to businesses with a turnover between $75K and $50 million that have experienced a revenue decline of 30% or more. The fortnightly payment amount is determined for employing businesses by 40% of their weekly payroll (minimum payment of $1,500 and maximum payment of $10,000 per week). For non-employing businesses, the fortnightly payment is $1000 a week. Applications open in late July, with no date currently specified.

COVID-19 DISASTER PAYMENT

The COVID-19 Disaster Payment is a one-off cash payment for each period of lockdown, from the federal government (Services Australia). If you’ve lost from 8-20 hours of work, you can now receive $375 (increased from $325). If you lost 20 hours or more of work, you can now receive $600 (increased from $500). Previously, this was only available to people for people with less than $10K of liquid assets and people from the Greater Sydney but this threshold has now been waved and is now available to anyone in NSW losing hours of work. You just need a Centerlink account attached to your mygov account (you can set this up if you don’t have one already).

More information on claiming a payment from Service Australia here>>

If you have lost hours of work you can call Service Australia on: 180 22 66

SMALL BUSINESS FEES AND CHARGES REBATE

A rebate worth $1500 is available from the NSW Government to help small businesses and sole traders pay for government fees and charges. To be eligible for this rebate, small businesses (including non-employing sole traders) and not-for-profit organisations must have a total of Australian wages below the NSW Government 2020-2021 payroll tax threshold of $1.2 million and have an Australian Business Number (ABN) registered in NSW and/or have business premises physically located and operating in NSW. Only one $1500 rebate is available for each ABN. You can apply for this rebate through Service NSW.

More information and application processes can also be found online here>>

HELPFUL LINKS FOR SMALL BUSINESS FINANCIAL SUPPORT

- Service NSW Business Concierge, advice for small businesses

- COVID 19 Assistance Finder (Service NSW)

- NSW Government Grants and Loans

- NSW Government 2021 COVID 19 Support Package

Thank you to Ausdance NSW for this valuable information.